It was just a simple 1 inch 3-ring binder that I added some pretty scrapbook paper and dividers to. In it I keep our Budget Worksheet, Other worksheets, Bills to pay, Paid Bills, our cash envelopes, checkbook, stamps, calculator and of course, a pen. We are doing a Ramsey-ish plan. Budgeting every penny every week or month, with any excess going towards our debt reduction plan.

It's not going to be easy, but I'm pretty sure I'll get a high off paying off credit cards and watching our savings account grow. Perhaps that high will outweigh the one I usually get from buying pretty new things for me, the kids or our house!

Ahh, the precious envelope system. This is the first month I'm trying to grocery shop with cash. The hardest part is knowing how much your tally is before you get up to the register so you don't go over (1 of 2 things might happen if you do go over....1. You have to use your debit card and move some of your budget around or 2. Send things back....to embarassing for me, I will always choose option #1 and adjust later) You'll see there are only 4...Groceries, Household, Fuel and Entertainment. All the rest of my bills are paid with a check or mostly Online Bill Pay. These are my most common expenses I pull out the Debit Card for. Now Debit Card usage is for emergencies only! I'm actually considering opening another Checking or Savings account to attach the Debit Card to, so it's not coming out of the Household Bill Account.

On Monday I attended a Consumer Protection Conference in Augusta. One of the segments was on budgeting. The presenter recommends you have at least 2 Checking Accounts and 2 Savings Accounts. The Checking Accounts are for Fixed Expenses (i.e Set payments) and Variable Expenses (Groceries, Auto Fuel...etc) and the Savings Accounts are for Emergency Savings and Accrual Expenses like Property Taxes, Heating Oil, Christmas, etc. And the most important thing I took from it is to do your Monthly Budget based on 4 weeks every month. Ignore the 5th week that happens twice a year.

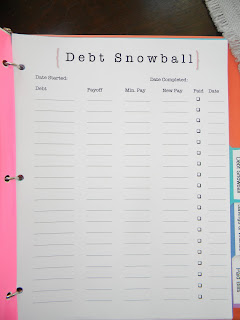

Here is our Debt Snowball worksheet. This is all Dave Ramsey. Basically, list your debts SMALLEST to LARGEST Balances (NOT interest rates). Pay the minimum payment on all but the top one. After you have put $1000 in Savings, start applying all extra cash to the top debt. Once that debt is paid off, take the full amount you were paying to that and apply it ALL to the next debt ON TOP of the minimum monthly payment! This is how the crazy "I paid of $20,000 in 12 Months!" stories happen! By the time you get to last debt, even though it's the largest, the payment is substantial! Hopefully this time next year, I have one of those stories to share with you!

Our Savings Worksheet. It's just a snapshot to see how we're doing on savings without getting a monthly statement. Really, I just like to write things down.

I also use software on my computer. Because I have a Mac, financial software that I like, took a bit of research to find. I was using Microsoft Money on my PC and I liked that fairly well. I'm very familiar with using Quickbooks and like how that works too, but read tons of bad reviews on how Quickbooks works with a Mac. I found MoneyWell. It was okay, but not super user friendly. It was free....that was a good thing but I eventually stopped using it because I just couldn't figure it out. Now, though, I've found one I really like and had great reviews. IBank. It did cost about $60 but it's a one time charge and I really, really like it! So is that redundant? Yes, a little bit. But writing things down is a very powerful tool in helping to keep you accountable. It works for dieting and it works for finances!

And here is what I've been working on: Monthly Budget Worksheet. I've made it available as a PDF if anyone would like to use it! It doesn't look too fancy there, it's what the Excel version that I've been formulating does that's magic! If you would like the Excel version, please comment or email me with the email to send it to, and I'd be happy to do it! You can also download my Debt Snowball form.

I hope our effort to clean up our finances inspired you! The hardest part will be saying No. No to dinner out, no to going out for drinks or to the movies or anything else that isn't in the budget. Of course we aren't quitting cold turkey, we've built in a little money monthly for that stuff....but trust me, it won't get very far and once it's gone, it's gone! Thats the key and the hardest part!

Good luck! (To all of us!)

~ Cerina

Great blog this morning Cerina! Good luck with your plan, hope it works for you. I know it will be tough, but stick with it. The long term rewards will be wonderful!

ReplyDeleteGood Luck!!

ReplyDeleteYour organization will go a long way! Good luck!

ReplyDeleteSo organized...and such a clever idea.

ReplyDeleteBtw, I awarded u The Versatile Blogger Award… Just go to http://bit.ly/edDVkU and copy and paste into your own post.